What is a Standing Instruction?

A Standing Instruction is given to your bank to execute transfer of funds for a specified value to a specific account, on the same date of every month.

By setting up a 'Standing Instruction' with your bank to transfer funds to your Sharekhan trading account towards Stock SIPs or Mutual fund SIPs, you will no longer need to initiate an amount transfer, or send us a cheque every month. Now you can execute your Systematic Investment Plan with the ease and leave all the tedious fund transfers to us.

The four simple steps to do this are:

Log in to the Net Banking site of your bank. You can use any one

of your bank accounts that

support this facility

In your Net Banking interface, find

“Fund Transfer” and click on it. For this functionality to work, you will need to pre-register for the Fund Transfer Facility with your bank

Register Sharekhan as a Payee with

the following details:

BANK

NAME |

ACCOUNT

NO. |

ACCOUNT

NAME |

IFSC

CODE |

MICR

CODE |

HDFC Bank

Fort Branch |

15770340013466 |

Sharekhan Ltd

SIP Account |

HDFC0000060 |

400240015 |

We request you to exercise due diligence while entering the details. As per RBI guidelines, The bank will

not be held responsible for any incorrect online transactions and disclosure of account-related details.

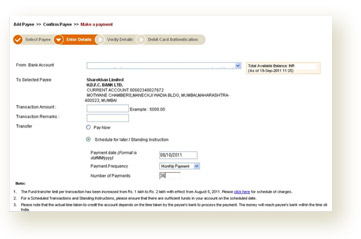

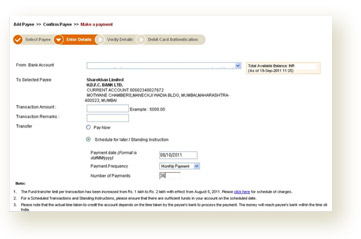

Set a ‘Standing Instruction’

with your choice of:

- Date and month

- Amount

- Payment frequency

- Number of payments.

PLEASE NOTE

1. Funds for 'Auto Sweep' enabled Mutual Fund SIP’s would automatically be allocated from your trading

account to the MF account.

2. Manual Allocation would have to be initiated from your trading account to the MF account in case

‘Auto Sweep’ is not activated for SIP's.

3. The facility of setting up Standing Instruction online is currently offered by ICICI Bank, Citibank,

HDFC Bank and State Bank of India

4. All fund transfers will take 3 working days to get credited into your trading account hence request

you to set the transfer date well in advance / prior to the SIP date.

For example, if your SIP date is 8th of every month then the fund transfer date should ideally be 5th of every month.

For example:

Mr Ram has set up a SIP in his Sharekhan online mutual fund account to invest in one of Sharekhan’s Top Equity recommended fund – IDFC Premier Equity. The SIP amount is Rs 5000 and the date of investment is on the 10th of every month for the next 3 years

(36 months). He sets up a ‘Standing Instruction’ on his bank account to transfer money on the 7th of every month

( 3 days before the SIP date) for the next 36 months. This will ensure that all his SIP transactions get executed successfully.

For any queries

If you have any doubts regarding setting

up your Standing Instructions with your

bank, you can get in touch with us on: