April 6, 2021

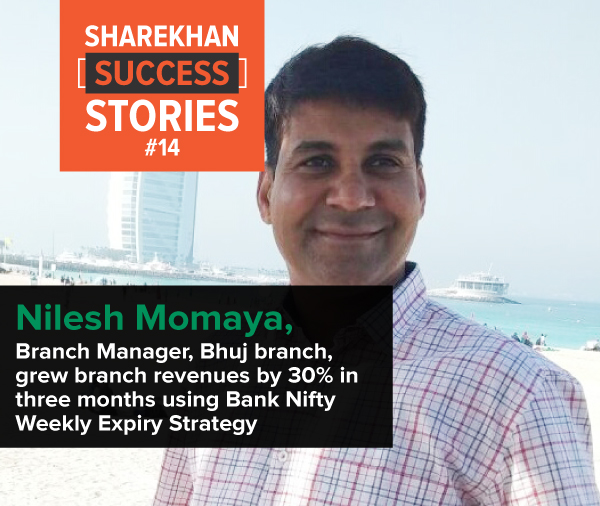

Sharekhan has been grappling with dwindling brokerage yields, continuous attrition and weakening market share for the last few months. Growing revenues besides by “luck by chance” is getting tougher and tougher for everyone in the Branch Network. However, Nilesh Momaya, our Bhuj Branch Manager from the cluster led by Anahita Vora, not only helped clients earn money but also generated more revenue for the company by promoting Bank Nifty Weekly Expiry Strategy among the clients. Over 180 clients enrolled for our Advisory strategy which resulted in the branch increasing the revenues by close to Rs.1 lakh on the expiry days. This translated roughly into Rs.4 lakh additional revenue in a month. The strategy's revenue contribution has been gradually rising and it has now become a controlled business due to the repeat weekly business from the same clients. The direct revenue from the Bhuj branch grew from Rs.17 lakh in December 2020 to Rs.22.3 lakh in March 2021, up a whopping 30%. Come, let’s hear more about the success story from Nilesh himself.

Internal Communications Team (ICT): Congratulations, your branch increased its revenue by 30% in three months and was on top in the Branch Network in terms of traded clients from the Bank Nifty Weekly Expiry Strategy in March 2021. How does it feel?

Nilesh Momaya (NM): It is a proud moment for us to have been the number one branch in the weekly expiry strategy for all four weeks of March which resulted in a rise in the branch revenue. My philosophy in life is to "think big" and "achieve big". Along with this we use an aggressive business strategy in our servicing to help us achieve exceptional results. Salman Sethiya and Uday Vikaramsey, two members of my team, put in a lot of effort by enrolling clients in the strategy and they have also been the pan-India leaders in the strategy for the past four weeks. Our aim is to provide the best service possible to our clients and we can see the results of our efforts.

ICT: How do you identify clients for the weekly expiry strategy and what is your pitch?

NM: Our belief is that if our clients make money as a result of our advice, our business will expand automatically. After a slow start, we realised that the Bank Nifty Weekly Expiry Strategy provides a good opportunity for clients to make money with limited risk in options. As a team, we decided to go big on promoting the strategy and began identifying clients who had previously traded in futures and options (F&O) as well as clients who are currently trading in both cash and F&O. We began pitching the strategy to them and our pitch was straightforward: The strategy has been successfully back-tested, achieved positive results since its inception and has impressive strike rate all of which increase the probability of it making money with limited risk. Our team is very old and we have strong and long relationship with all our clients. Our clear commitment and planned pitch paid off, and we now have 180+ clients enrolled for the strategy. In the coming weeks, we want to take the number to 250 clients.

ICT: How is the strategy helping your branch to increase its revenue and activity?

NM: The revenue for the month of March was the highest in the branch's history since its inception; we earned Rs.22.3 lakh in revenue, and the branch's IE ratio exceeded 5. Every week, during expiry, the Bhuj branch sets a new revenue record; last week's expiry brought in Rs.2 lakh, with Rs.1.10 lakh coming from the weekly expiry strategy. Because of the positive results of our weekly expiry strategy, we have been able to obtain more client referrals, our branch activity ratio has improved and we have been able to increase our F&O average daily turnover (ADTO) to Rs.200 crore versus our target of Rs.50 crore. As a consequence of the efficient service provided by the Relationship Managers of my branch, the clients appreciate and understand the importance of a full-service broker. In my view, we will never face a brokerage reduction issue if we provide good and adequate services to the profiled customers.

Advisory strategy promote kar, branch revenue increase kar, Sharekhan kar.

| Join us on |