April 17, 2023

The new financial year 2023-24 has already started and it is time for all Sherus to submit a declaration of deductions and exemptions that they want to claim so that the company can deduct tax from their salary on the basis of these declarations. As you know, you can now declare your investments online on our human resource management system, ShareKonnect. We have opened the Investment Declaration page on the portal for all employees to declare their investments for FY2023-24.

To help you, we have explained below how to select the tax regime and declare investments on the Sharekonnect, it is easy and quick. You may also refer the attachment to understand which tax regime is better for FY2023-24. We are also going to organise virtual training sessions to run you through the process of declaring your investments on ShareKonnect. Please make time to understand the whole process to avoid any hassle later.

Points to note

- At the time of declaring your investments, you can choose the “Tax regime” option only once in a financial year.

- In case you claim exemptions and deductions, such as House Rent Allowance, Leave Travel Allowance, the benefits under the sections 80C and 80D of the Income Tax Act etc, you should opt for the old tax regime as these exemptions and deductions cannot be claimed under the new tax regime. Hence, it is important to clearly understand the impact of the choice of tax regime on your income tax.

- The new tax regime shall be treated as the default regime. The employees wanting to opt for the old tax regime should specifically choose the option. In case employees fail to update the tax regime on ShareKonnect, their income tax will be calculated on the basis of the new income tax slabs under the new tax regime.

- The last date for declaring your investments is April 24, 2023.

- Physical copies of investment proofs are not required for declaring investments on ShareKonnect, only investment values are needed.

- Declaration of investments and submission of investment proofs after the last date will be accounted for in the May 2023 payroll and tax will be deducted accordingly from the month’s salary.

Highlights of new income tax regime

| Particulars | Old Tax Regime | New Tax Regime |

| Income level for rebate eligibility | Rs.5 lakh | Rs.7 lakh |

| Standard deduction | Rs.50,000 | Rs.50,000 |

| Effective tax-free salary income | Rs.5.5 lakh | Rs.7.5 lakh |

| Income tax rebate u/s 87A | Rs.12,500 | Rs.25,000 |

| Surcharge rate above Rs.5 crore | 37% | 25% |

How to declare investments on ShareKonnect in 5 easy steps

| Step 1: Log on to ShareKonnect with your credentials and go to the “Dashboard”. |

| Step 2: On top left, below the “Self-Attendance” heading, click on the clock icon in blue to access the blue series of tabs on top. |

| Step 3: Click on the “Payroll” tab and select “e-Investment Application” from the dropdown menu. |

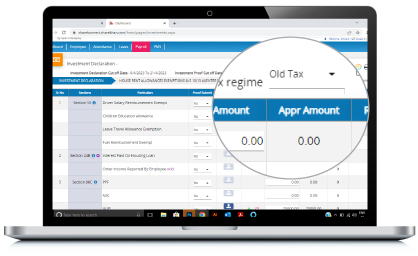

| Step 4: Click on the “Tax regime” dropdown menu that appears above the digital form and select the applicable option from the menu (“Old Tax” or “New Tax”). |

|

| Step 5: Enter your investment details on the digital form below and save the data by clicking on the green “SAVE” button at the bottom of the page. |

|

|

If you need more clarity, please attend any of the four virtual training sessions we are going to conduct over the next few days on the WebEx platform starting from April 18, 2023.

Schedule for virtual training sessions on investment declarations and tax regimes

| Date | Time | WebEx Meeting links | Meeting number | Password |

| April 18, 2023 | 4pm to 5pm | https://sharekhan.webex.com/ sharekhan/j.php?MTID=m3d925 a0da8d582e197f73ad00f31fd19 |

2514 711 3608 | 123456 |

| April, 20 2023 | 4pm to 5pm | https://sharekhan.webex.com/ sharekhan/j.php?MTID=m0fdf90b20 fa3ce1cbc85cf2ad02f6ef5 |

2511 804 6156 | 123456 |

| April 21, 2023 | 4pm to 5pm | https://sharekhan.webex.com/ sharekhan/j.php? MTID=m7 ca6398997f40ef1 d3132af9efe9ff7f |

2514 207 8242 | 123456 |

| April 24, 2023 | 4pm to 5pm | https://sharekhan.webex.com/ sharekhan/j.php?MTID=mc39129925c8 a9545a97184070d280b5f |

2516 731 9207 | 123456 |

Please declare your investments on time to avoid tax deductions.

For any assistance write to us at payroll@sharekhan.com with your employee code.

| Join us on |