In the last five years, there have been many conflicts and adversities that have affected economies negatively. The Covid-19 pandemic wreaked havoc on global markets, just as military conflicts in Ukraine and the Middle East continue to exert headwinds till today.

Even large economies such as USA and China have not been untouched.

Against the run of play, though, the Indian stock market has been resilient and even grown stronger. In the last decade, the Sensex has witnessed a growth of 202%, going from 27,316 pts on June 19, 2015, to 82,445 pts on the date of publication. Furthermore:

| In 2024 alone, there were 190 lakh new demat accounts opened in India. |

Let’s look at the fundamental reasons responsible for the optimism in the growth potential of the Indian stock market.

Strong Economic Fundamentals

One of the greatest assets of India’s economy is its well-entrenched financial stability. Its public finances are sound; its external accounts are largely undisturbed by any uncertainty and there is a robust and well-regulated banking system at the crux of the economy.

The scrutiny and systematic discipline enforced by SEBI (Securities and Exchange Board of India) have ensured that all major private and public sector banks in the country operate seamlessly and transparently for the benefit of their customers.

These ensure a financial backbone well buttressed against any adverse external factors. As a result, India’s base of economic transparency and strength make it resistant to economic upheavals that plague the rest of the world.

Increasing Investor Confidence

At the end of FY2024-25, there was a record of 1924 lakh demat accounts in India. This all-time high has been achieved as a result of several factors. Due to a sentiment of political stability reinforced by the Lok Sabha Elections and a resultant upbeat economic outlook, there has been, almost invariably, an incredibly high point of investor confidence in the country.

Even with the recent military engagements between India and Pakistan, the investing sentiment in India has remained intact. In fact, many investors were keen to capitalize on growth of defence and defence-related stocks.

This is a further affirmation of the fact that India’s financial literacy is on an upward trajectory as well. It is expected, however, that with a higher level of financial awareness and investor education, the public participation in the stock market will only increase manifold in the years to come.

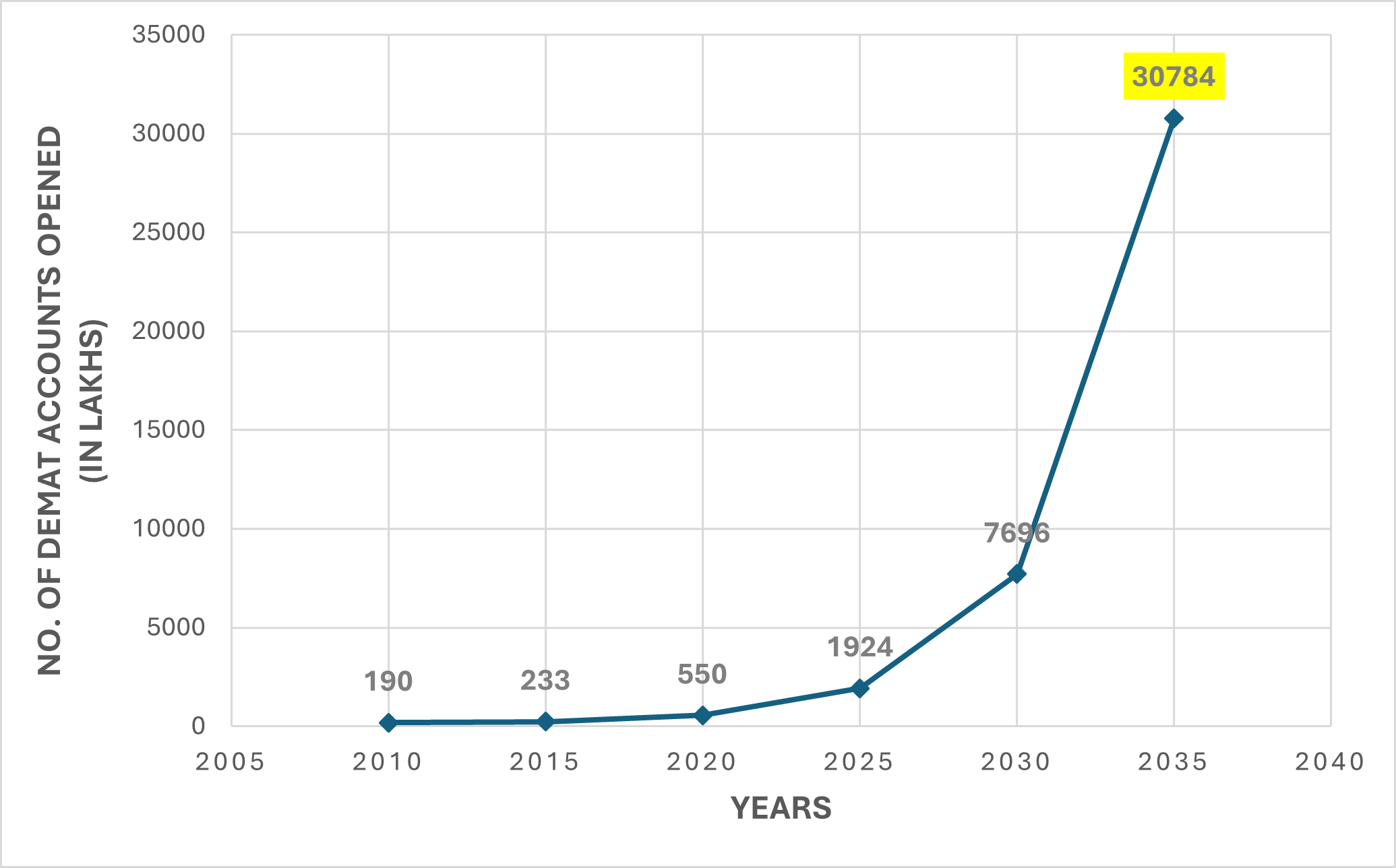

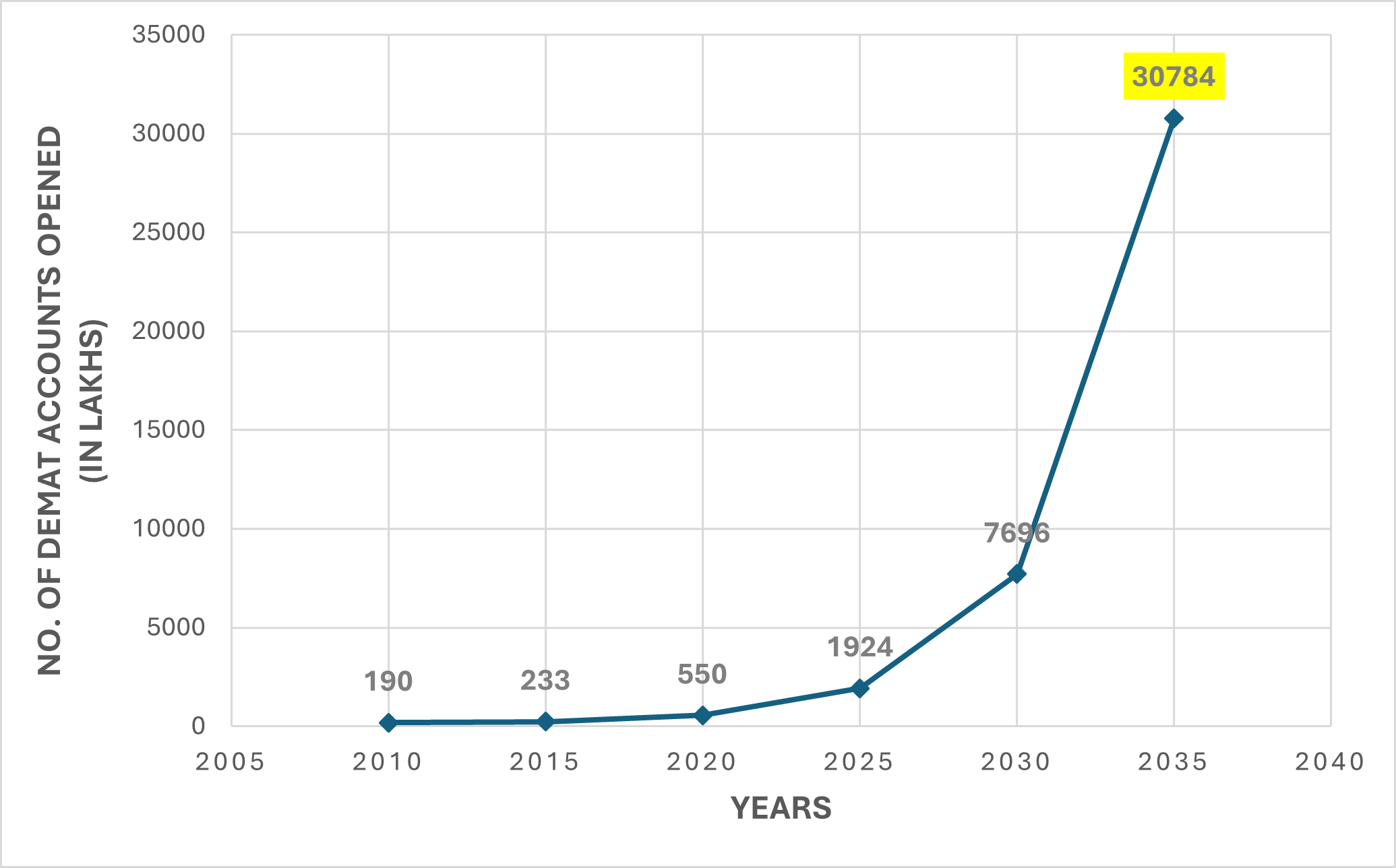

Growth of Number of Demat Accounts in India

Extrapolation for the future is based on estimates basis past performance; past performance is not indicative of future numbers

Key Takeaways from the above graph

- In 2030, it is estimated that there will be 7,696 lakh demat accounts in India.

- In the next 10 years, it is estimated that there will be 30,784 lakh demat accounts.

- Between 2020 and 2025, there has been an increase of 250% in demat accounts.

As of December 31, 2024, the National Stock Exchange (NSE) is the fifth-largest stock exchange in the world with a monthly trading volume of Rs 25 lakh crores. Impressive as this is, there is still a lot of room for further growth.

Japan, whose Japan Exchange Group is on the fourth position, has a population of around 1,230 lakh people with a monthly trading volume was worth Rs 55 lakh crores, from nearly 500 lakh online brokerage accounts.

This indicates that the Japanese populace is far more aggressive in trading and investing than we are and that there is still a lot of potential in our present population of 140 crores to mint a new record in either the number of demat accounts or the trading volume recorded by market participants. With this upcoming surge in retail investors, this would be an ideal opportunity for you to expand your base of customers as well.

Demonetization and Digitization

In 2016, the Government of India announced demonetization of Rs 500 and Rs 1,000 currency notes, as an initiative to stem the tide of black money and discourage crimes such as counterfeiting and evasion of taxes. Initially, this had an adverse effect on the stock market, leading cash-dependent sectors such as banking, consumer goods and real estate to plummet.

However, gradually, as cashless transactions became the order of the day, financial digitization bolstered investor confidence and led to a surge of growth based on higher transparency due to stronger tax compliance. Moreover, during the pandemic, digitization further set in and enabled a flow of liquidity for the economy.

Thanks to this advent of digitization, the process of opening demat accounts has become completely paperless. In fact, it’s not just investments that have been accelerated by digitization. Transactions of mutual funds and insurance policies have also been speeded up dramatically with a seamless integration of information.

A most recent case in point: the new Bima Sugam Project has been undertaken by Protean eGov Technologies, which is responsible for maintaining several critical centralized databases of India’s citizens. These developments demonstrate that the backbone of the digital infrastructure of the country is strong and getting stronger.

The IT Sector’s Ongoing Growth

As of now, the domestic revenue of the IT industry is estimated at around Rs 4.36 lakh crores. This itself indicates that the IT industry is one of the major contributors to India’s economic growth. Of late, however, concerns over the potential increase in attrition, due to artificial intelligence replacing human resources in many fields, have slowed down this new surge of growth to an extent. Nevertheless, if automation and human skill can be possibly blended in a suitable fusion of interdependency, more employment opportunities can be created again to bolster this sector’s growth significantly.

At any rate, India’s fast progress in digitization, across industries and sectors, suffices in spearheading the country’s technological advancements. The growth of the IT sector and the other factors listed above will all go a long way to ensure that the Indian stock market continues on its upward trajectory and even scales unprecedented heights. This is an opportunity for every aspiring investor or trader, and it is also an excellent business opportunity for you as well.

A Robust Fast-Moving Consumer Goods Sector

In the Indian economy, certain sectors and industries have remained fundamentally strong and capable of yielding exponential growth for investors. This is particularly the case with the Fast-Moving Consumer Goods (FMCG) sector, which represents all essential goods of domestic and everyday usage and consumption such as food, detergent, personal care products, cleaning materials, and stationery. It is dominated by major multinational players such as Hindustan Unilever, Nestle India and even domestic brands such as Dabur and ITC.

Trade pundits estimate that the FMCG sector is all poised to expand to a market size of Rs 18 lakh-21 lakh crores in 2025. With factors such as a sizable population of young consumers, an ever-increasing penetration of smartphones and strategic subdivisions of new niches for products such as those aimed towards pets or to growing children, this sector can alone drive the stock market to new heights.

Greater Independence from Foreign Investors

Another factor that has been conducive to the growth of the Indian stock market has been the Indian economy’s conscious restraint on influx of foreign investments. Foreign investments have always been an indispensable part of overseas revenue for the economy, but they have also left it vulnerable to global geopolitical tensions and upheavals. As the numbers of domestic and retail investors have increased exponentially, in the last decade particularly, there is naturally a lesser dependence on foreign investments and this has, in effect, protectively insulated the stock market from being more severely affected by global conflicts, risks and uncertainties and has also recently protected it from the ongoing geopolitical tensions in Europe and the Middle East. This has made the market more secure and stable for the investment advisory business.

Regulatory Reforms by SEBI

In the last 10 years, SEBI has been at the forefront to regulate the financial market in India rigorously to ensure a higher level of transparency and security. This, in turn, has fostered a greater level of confidence among retail and institutional investors in the stock market. Here’s a quick glimpse through some of the most significant regulations introduced by SEBI in the previous decade.

- Regulations for REITs and InvITs that enabled investors to invest in infrastructure and real estate companies

- Standardized disclosures and corporate governance norms to safeguard investor’s interests.

- Mandatory Dematerialization of Shares for Transfer to streamline transactions and prevent occurrences of fraud

- Stringent penalties and laws on insider trading

- New norms for FPIs (Foreign Portfolio Investors) to prohibit market manipulation and improve general integrity

- Tighter margin requirements for Derivatives Trading to limit speculative trading

- Norms for greater accountability and integrity in listed companies

- Stewardship Code to encourage collaboration between mutual funds and investee companies

Moreover, with the introduction of the T 0 settlement schedule, transactions of shares and securities have been further streamlined by ensuring that their delivery takes effect on the same day as when the orders are originally placed. Such developments have boosted investor confidence significantly and have also created a transparent and trustworthy business atmosphere.

With such favourable factors, it can be expected that the Indian stock market will grow further and even rapidly on an upward trajectory. Now is indeed the right time and opportunity for you to take your business to new directions.